Personal Income Growth In Arizona To Be Flat

What The Recovering Arizona Economy Means to REALTORS®

by Ron LaMee, Senior VP of Research and Member Value, Arizona Association of REALTORS®

The third of four related topics which include:

- Arizona population will increase faster than the national average

- Arizona job growth to exceed population growth

- Personal income growth in Arizona to be flat

- Meet the economy head-on with concrete tips for REALTORS®

For most REALTORS®, 2014 will be a respectable year, but probably won’t break any records. Looking forward to 2015, this is an excellent time to move outside your normal routine. Attend some real-estate-related meetings (office meetings, mixers, MLS marketing meetings) and check out what is going on around you. Investigate new technology and business ideas very carefully, plan your course of action and make sure you are properly positioned when business picks up again. For details on the economic picture and more tips, read on.

Personal income growth in Arizona to be flat

After looking at positive figures for population and job growth, it is time to come back to Earth: personal income just isn’t growing the way it did when our economy was booming. The Per Capita Personal Income chart below can be found at the Arizona Indicators website at http://arizonaindicators.org/visualization/capita-personal-income-inflation-adjusted-percent-change. The website is interesting to work with as you can turn on graph lines for each Arizona county to compare income figures to each other, the U.S. or Arizona as a whole:

The lines in the Per Capita Personal Income graph sawtooth up and down, but there has been more down than up since the most recent peak in 1997. Interestingly, note that incomes of Arizonans tend to overshoot the U.S. average, both rising and falling. Incomes had been recovering from the brief dot-com recession in the early 2000s; the Great Recession caused a deep plunge followed by a recovery in 2011. Recently, it looks like we are back to zero growth. The trend of low- or no-growth is clear—this isn’t a big shock since many people feel it. Let’s see why this is.

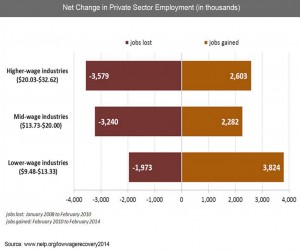

The Net Change in Private Sector Employment chart to the right from the National Employment Law Project is quite revealing. The U.S. has regained almost as many jobs as it lost but at a lower wage. Of the 9.7 million jobs lost at an average of $19.49/hour, the 9.7 million we regained average $17.13/hour—over a 15% decrease not counting inflation. Some experts attribute this decrease to employers hiring more temporary and part-time workers. Until we get further along in the recovery, we won’t know if this downward trend will last.

The Net Change in Private Sector Employment chart to the right from the National Employment Law Project is quite revealing. The U.S. has regained almost as many jobs as it lost but at a lower wage. Of the 9.7 million jobs lost at an average of $19.49/hour, the 9.7 million we regained average $17.13/hour—over a 15% decrease not counting inflation. Some experts attribute this decrease to employers hiring more temporary and part-time workers. Until we get further along in the recovery, we won’t know if this downward trend will last.

Prospective home buyers not only need inventory to choose from, but liquid funds for purchase. Many factors impact liquidity: capital still tied up in underwater mortgages, savings depleted by the deep recession, layoffs leading to lower-paying jobs, etc. Poor liquidity in personal finances is likely one of the reasons for lower demand in most housing markets and will continue to be a factor for the foreseeable future.

Good luck with all you do. Check back tomorrow for the next section, Meet the economy head-on with concrete tips for REALTORS®. Don’t hesitate to contact me with any suggestions or comments.

Ron LaMee

Senior VP of Research and Member Value

Arizona Association of REALTORS®

ronlamee@aaronline.com