Arizona Residential Real Estate Market Report – May 2016

This is a snapshot of four different regions of the Arizona real estate market for May 2016. For more about how these segments are divided, please see the note at the end of this article.

Quick Takeaways – Real Estate Across Arizona

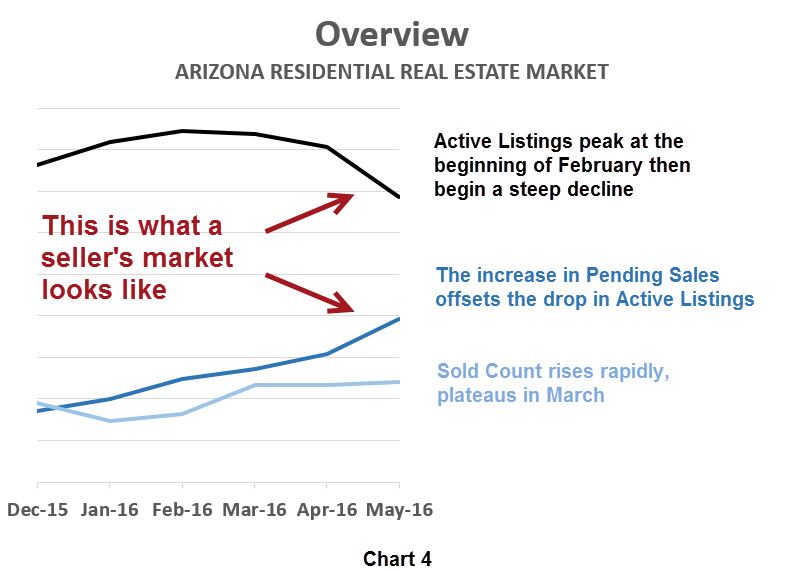

We’re in a seller’s market. Sales are fairly stable, except in the Northern Highlands which surged this month. Inventory is down again in May for the fourth month in a row, 20-percent lower than its peak earlier in the year.

Demand remains strong, but sooner or later tightening inventory is going to put the brakes on. It will be interesting to see when our seasonal drop-off in market activity takes hold.

To get some perspective on the volume of new residential contracts impacting our Arizona real estate market, the total value of properties put under contract last month was over $4.6 billion dollars, which is 50% higher than the $3.1 billion of May 2015.

A Change in Measures for This Report

Beginning with this edition of the report, “Pending Sales” is switching to “New Pending Sales.” Pending Sales is the count at the end of the month for all properties under contract. New Pending Sales reflects the new sales contracts created that month.

Contract-to-closing usually averages 30-60 days, so Sales Count is a reflection of what buyers were doing a couple months ago. Since New Pending Sales is the number of new contracts accepted in the most recent month, it’s an updated picture of overall market activity.

Sales Fairly Stable Statewide as Northern Highlands Take Off

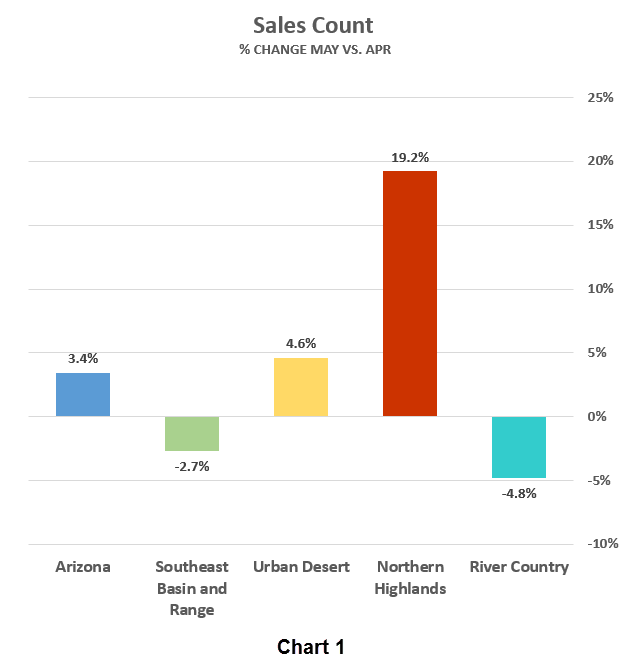

While April’s Sales Count was flat, May shows slight ups and downs in different areas (Chart 1). However, the Northern Highlands, which has been poised to launch all spring, finally caught up with the other active markets across the state.

As you look at the figures in Chart 1, remember that May’s slight gains and losses are stacked on top of strong market activity in the first three months of the year. That said, the 19-percent jump in sold units in the Prescott/Payson/Pine/Flagstaff/White Mountains markets is “H-U-U-U-U-G-E!” (as one of our presidential candidates might say).

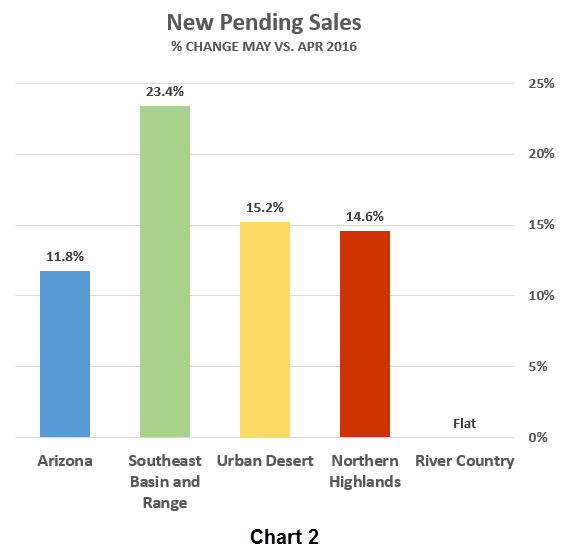

As noted earlier, we’re watching “New Pending Sales” instead of “Pending Sales” in May. Chart 2 indicates that most of the state continues to enjoy an expanding market. Only the River Country is flat, but May’s figures are still the year-to-date peak set last month—activity in this region is pausing, not decreasing.

In May as in April, New Pending Sales indicate that June will be another good month for sales.

Inventories Drop Further, New Listings Down Again

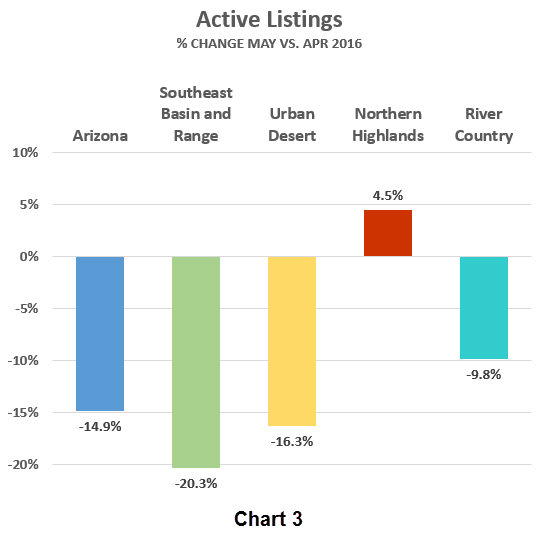

The housing inventory situation in Arizona is going from limited to tight. The flow of new listings into inventory was down 7.6% this month, following April’s 2.5% decrease. The total inventory in the state is shown in Chart 2.

The last time Active Listings increased was in January; since then inventory has decreased 4.4-percent, 8.5-percent, 5-percent each successive month and is now nearly 15-percent lower in May. When fewer sellers are selling and more buyers are buying, the result is inevitable: an expanding seller’s market.

What Does a Seller’s Market Look Like?

Sellers have an enviable problem: How to maximize gains in a favorable market. Although For Sale By Owner homes make up 9-percent of sales in our region, they typically sell for 18.6-percent less than agent-assisted home sales per a 2015 survey. REALTORS® have more experience marketing property, sorting through offers, smoothing the closing process and helping sellers find new homes too!

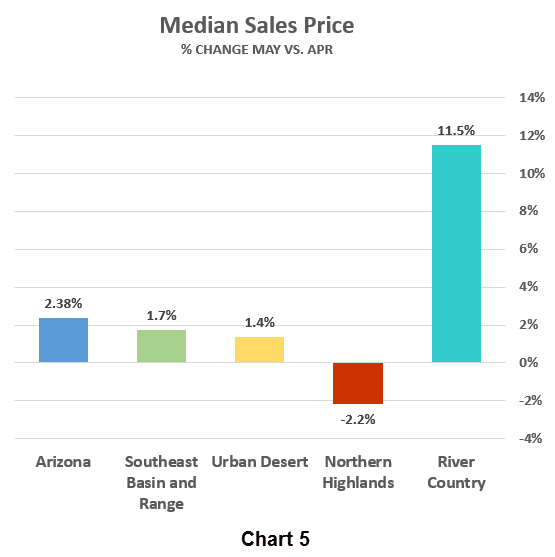

Prices Continue Upward Trend

For the third month in a row, Median Sales Prices in Arizona inch a little higher (Chart 5). Considering the strength of our seller’s market, moderate price increases are a sign of a healthy real estate market.

It’s worth mentioning that the statewide Median Sales Price of $215,000 compares with an average sales price of $265,000. This means that there is more activity in higher price ranges than in lower price ranges, and reflects the greater number of transactions occurring in urban areas where prices are higher.

Also interesting to note is that Median Sales Prices increased rapidly for Northern Highlands in April, but fell back in May. On the other hand, River Country had a large increase in value in May, but gained less than 1-percent in April. In smaller markets, this underscores how sales activity at lower or higher price ranges may impact the overall mean value.

Note

These statistics are sourced from the REALTOR® Property Resource (RPR), which draws them directly from MLS systems across Arizona. In some cases, RPR reports its statistics differently from MLSs, which may occasionally result in dissimilar figures. For discussion purposes, the state of Arizona is divided into four distinct regions. While we could chose regions many different ways, these groupings work well in terms of climate, economies and terrain.

| Urban Desert | Maricopa and western Pinal counties | |

| Southeast Basin and Range | Tucson and counties south and east of Pima | |

| Northern Highlands | Flagstaff, Prescott, Sedona, Payson and White Mountains | |

| River Country | Kingman, Bullhead City, Lake Havasu City and Yuma |