Why More Canadians May Sell U.S. Properties in 2016

Many Canadians own residential real estate in Arizona. They are especially attracted to the desert areas of Arizona during the winter when they can soak in the sun rather than shake off the snow.

Many got spectacular deals purchasing residential properties when prices were low and the Canadian dollar was close to being on par with the U.S. dollar.

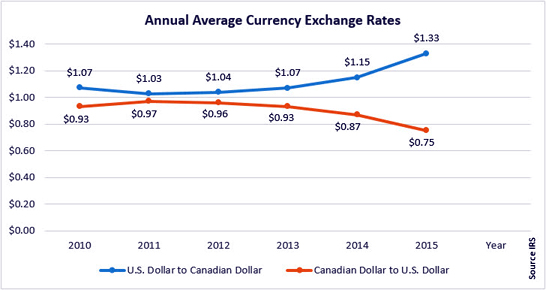

Changes in the Canadian economy and dollar make it likely that there are now fewer Canadian buyers, but more sellers of their U.S. properties. According to the Wall Street Journal on February 25, Canada’s economy is under pressure because of a drop in oil prices. In 2015, the Canadian-to-U.S. dollar average was at .75 cents compared to .97 cents in 2011.

Let’s look at a scenario as to why more Canadians may sell their U.S. properties this year than in recent years.

If a Canadian bought a house in the U.S. in 2011 and paid $150,000 USD, they would have paid close to $155,000 CAD. In 2015, if that same property, because of appreciation, sold for $225,000 USD, a Canadian seller would receive $300,000 CAD, almost double what they paid in Canadian dollars in 2011. Quite a gain. So far in 2016, the Canadian dollar is even weaker against the U.S. dollar than last year.

If a Canadian or if any foreigner, decides to sell their U.S. residential property, they should be aware of the Foreign Investment in Real Property Tax Act known as FIRPTA.

FIRPTA is the mandatory withholding of income tax on the disposition of U.S. real property interests by a foreign person(s) defined as a nonresident alien individual, a foreign corporation, a foreign partnership, trust or estate. According to the IRS, not only are sales under FIRPTA, but so are exchanges, gifts and transfers.

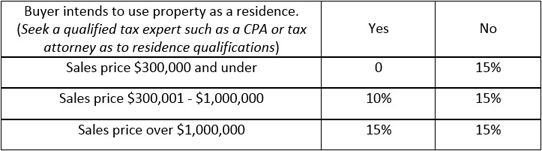

On February 17, the FIRPTA withholding tax rate increased up to 15% as demonstrated in the chart below:

According to FIRPTA, what is the buyer’s responsibility? A buyer is solely responsible for the FIRPTA withholding tax from a seller.

When the seller is a foreign person? The IRS states:

“In most cases, the transferee/buyer is the withholding agent. If you are the transferee/buyer you must find out if the transferor is a foreign person. If the transferor is a foreign person and you fail to withhold, you may be held liable for the tax.”

To help make buyers and sellers aware of FIRPTA, Arizona REALTORS® has addressed it in the Seller’s Property Disclosure Statement (SPDS) and Residential Resale Real Estate Purchase Contract (Resale Contract).

Lines 13 and 14 in the SPDS read:

“Is the legal owner(s) of the Property a foreign person or a non-resident alien pursuant to the Foreign Investment in Real Property Tax Act (FIRPTA)? Yes No. If yes, consult a tax advisor; mandatory withholding may apply.”Lines 135-138 in the Resale Contract read:

“IRS and FIRPTA reporting: Seller agrees to comply with IRS reporting requirements. If applicable, Seller agrees to complete, sign, and deliver to Escrow Company a certificate indicating whether Seller is a foreign person or non-resident alien pursuant to the Foreign Investment in Real Property Tax Act (“FIRPTA”). Buyer and Seller acknowledge that if the Seller is a foreign person, the Buyer must withhold a tax of up to 15% of the purchase price, unless an exemption applies.”

The seller in the Resale Contract agrees to comply with FIRPTA if they are a foreign person; if applicable, the buyer must withhold the tax. In the SPDS, the seller must indicate if they are a foreign person or non-resident alien; if they are, they should consult a tax advisor.

While different settlement agents may have different procedures, escrow officers are not equipped to give tax or legal advice concerning FIRPTA.

The IRS does not require the settlement agent to:

- Determine a seller’s status as a foreign person

- Decide how much FIRPTA tax should be withheld

- Decide if the seller qualifies for an exemption, or

- Complete FIRPTA forms

What then may a settlement agent do?

IF a buyer has determined that a seller owes FIRPTA tax, the escrow officer may assist them in collecting completed forms and withholding tax from the seller and buyer, and send the forms and taxes to the IRS on behalf of the seller and buyer. (Remember, there is no duty by the escrow officer to complete FIRPTA documents.)

IF a seller applies for an IRS certificate exempting or reducing FIRPTA withholding tax prior to the transaction closing, it is likely that the certificate from the IRS will not be received until post-closing. A settlement agent may agree to hold FIRPTA funds post-closing and send the funds to the IRS if certain conditions are met prior to the closing. If the required conditions are met, then both the buyer and seller will have to sign post-closing holdback instructions.

IF the requirements of a post-closing holdback are not met, the seller and buyer will have one of two options. The settlement agent may collect the proper forms and send in the withholding tax at the time of the closing. Or the seller and buyer mutually agree in writing that the FIRPTA funds may be transferred to an attorney or CPA’s trust account. The attorney or CPA will be responsible for the FIRPTA withholding amount.

Tips

If there is a FIRPTA withholding, both the seller and buyer will need either a social security number or a valid U.S. Individual Taxpayer Identification Number (ITIN) in order to process FIRPTA documents. If someone is not eligible for a social security number, they must apply for an ITIN.

Because of the length of time it may take to receive either a social security number or ITIN, it is a good idea to obtain one before a property is put on the market.

Also, talk with the escrow officer where the escrow will be processed prior to contract acceptance to find out what the officer will do on a FIRPTA transaction and what requirements must be met for a post-closing holdback.

A seller and buyer should always consult with a qualified CPA or tax attorney regarding FIRPTA.

Conclusion

In 2016, the Arizona real estate market will likely see more FIRPTA transactions with foreigners, specifically Canadians, selling their U.S. properties. A knowledge of FIRPTA by both the foreign seller and buyer will help ensure a smother closing.

Fletcher R. Wilcox is vice president of business development at Grand Canyon Title Agency

Tags: Canada, Canadian, FIRPTA, Fletcher Wilcox, Foreign Investment in Real Property Tax Act