Effect of Student Debt on Access to Homeownership

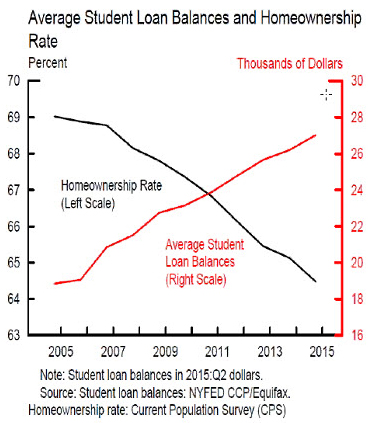

Daniel Ringo, an economist at the Real Estate Finance Section of the Federal Reserve Board, recently reported during a National Association of REALTOR® (NAR) University Speaker Series that, “Student loan debt might provide access to higher education, possibly increasing likelihood of homeownership [but] Student loan debt can have an economically meaningful effect on homeownership of borrowers.” Translation?

He went on to say that student loan debt may actually reduce the desire to take on more debt and every 10% increase in student loan debt decreases the probability of homeownership by up to one full percentage point with lasting effects of five or more years after college.

Many theories have been advanced for the slower-than-average entry into homeownership of Millennials. Some analysts argue that the financial crisis reduced employment opportunities just as Millennials entered the labor force, delaying and perhaps permanently reducing the career development and financial accumulation of this cohort. Other analysts have relied on sociological theories, arguing that Millennials have different attitudes towards marriage, family, and renting than prior generations. – Freddie Mac

NAR reported in its 2016 Home Buyer and Seller Generational Trends Report that: Millennials were most likely to cite student debt (53 percent) as the debt that delayed saving. In January 2016, that number rose to 58 percent in our Mountain Region with Arizona median student debt at $40K.

As a REALTOR®, what can you do to help motivate first-time buyers who are sometimes described as the “missing link” in real estate recovery? Inform them about the financial benefits of homeownership and how you can help them get their first set of keys.

In addition to a variety of tax breaks, 2015 reductions in Federal Housing Administration (FHA) mortgage insurance premiums increased loan volumes by double digits — including a whopping 67 percent in the third quarter of last year.

Want to move the needle? Educate student loan debt holders about the advantages of first-time homeownership.

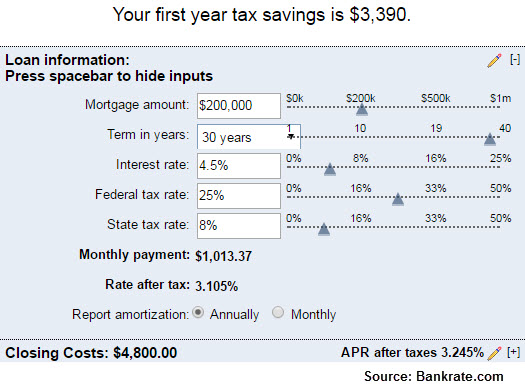

If a $40K student loan payment is around $450 per month and FHA has reduced premiums by an average of $900 a year, that’s already the equivalent of two month’s worth of college debt payments. With as little as 3 percent down on a $200K home, first-time buyers could save nearly $3.4K in taxes in the first year alone.

Add student loan interest deductions of up to $2.5K per year and the down payment is all but paid for.

Additional resources:

2016 Report On the Real Cost of Student Loans | GoodCall (June 2016)

Quarterly Reports on FHA Single-Family Mutual Mortgage Insurance Fund Programs | HUD.gov (March 2016)

Student Loan Debt Hampering Home Buying: A Regional Perspective | NAR (January 2016)

Effect of Student Loans on Access to Homeownership | Federal Reserve Board (November 2015)

Office of the Chief Economist: Insight & Outlook | Freddie Mac (September 2015)