Owning Versus Renting Across Income Brackets

REALTOR® University recently hosted a webinar entitled “Owning Versus Renting Across Income Brackets Under the Tax Cuts and Jobs Act” featuring Dr. Ed Golding, non-resident fellow of the Urban Institute and former head of the Federal Housing Administration.

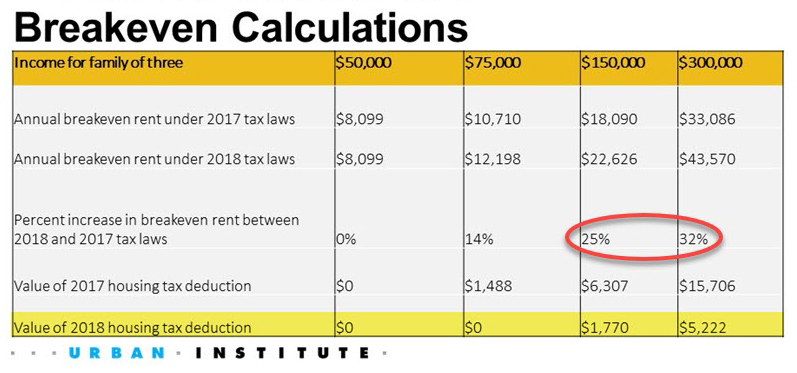

Here are a few of his forecasts based on 2018 Tax Reforms:

- Renting will look more attractive than homeownership for many

- For families above the median income, there will be a significant effect with the all-in user cost of ownership increasing by 25%+

- Higher income families could easily be paying an additional $10,000 in state taxes

- $300K HH: value of 2018 housing tax deduction dips from $15,706 to $5,222

Breakeven Calculations were based on these Assumptions, producing these Results.

- Expect a lower homeownership rate under the new tax law

- Young households delay ownership

- Older households move to rental properties earlier

Related stories:

Tags: Dr. Ed Golding, owning versus renting, tax reform, Urban Institute

Keep Your Trust in Real Estate, but Diversify

Tax Reform Impact on Real Estate Professionals

PREVIOUS POST: Why You Should Oppose Arizona House Bill 1210