Fannie Mae’s New Short-Sale Escalation Tool

If you’re a REALTOR® who has experienced difficulties dealing with inflated property valuations in conjunction with Fannie Mae short sales or other issues related to a Fannie Mae short sale, there’s good news. In response to an increased number of consumer complaints, Fannie Mae, based on input from NAR, recently rolled-out a new centralized web-based platform designed to enable agents to escalate short sale issues in a more productive manner. For more information, read the press release Fannie Mae issued yesterday. Through the new tool, agents will be able to open a case and receive confirmation that Fannie Mae is aware of their issue and actively working to achieve a mutually beneficial resolution.

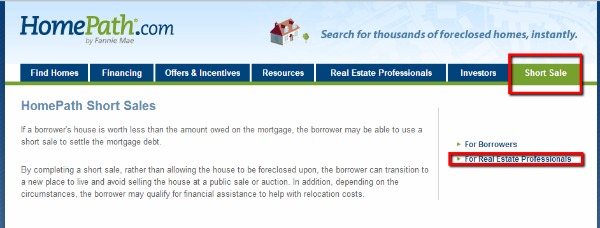

To use the escalation tool, visit www.homepathforshortsales.com (or homepath.com and click on the “Short Sale” tab). There, agents will find information regarding the escalation process, along with a tab titled “Get Started Today,” which enables the agent to escalate a variety of issues directly to Fannie Mae’s dedicated short sale team.

According to Fannie Mae’s website, agents should use this tool to contact Fannie Mae about a short sale when:

- You are ready to list a property and need a recommended list price;

- You want to contest a value Fannie Mae has assigned to a listed property;

- You haven’t heard back from the servicer; or

- You have an issue with an offer currently under negotiation.

During the escalation process, agents will be prompted to upload specific documents depending on the issue raised. In cases of a valuation dispute, agents should be prepared to upload: (1) MLS data sheets for three to six sold comps with listing history and REALTOR® comments; (2) an appraisal or BPO; (3) a recent CMA report with photographs of comparable properties, descriptions and listing history; (4) an inspection report with color photographs of any areas in need of repairs; and (5) any contractor’s estimates obtained for needed repairs.

In creating this new escalation platform, Fannie Mae has again emphasized its commitment to preventing foreclosures by processing short sales in a more timely and transparent manner. However, keenly aware that each and every short sale establishes a future comp, Fannie Mae will continue to balance these objectives against its desire to stabilize pricing and maintain neighborhood property values.